We often see news segments discussing the housing market and how current affordability challenges make it difficult for buyers. Although mortgage rates have indeed increased this year, we mustn't forget that there are other affordability factors to consider as well.

Here are three measures to establish home affordability: home prices, mortgage rates, and wages. Let's look closely at each one.

1. Mortgage Rates

Mortgage rates have been on the rise, and this has made it difficult for many buyers to finance a home purchase. Despite this, home prices are still high in many markets, although some areas are seeing slight declines. Wages have also been increasing, helping serious buyers remain in the market despite the high mortgage rates and home prices.

•Mortgage rates have increased by 3.83 percentage points since the end of last year, making it difficult for many buyers to finance a home purchase.

• Home prices are still elevated in many markets, but some areas are seeing slight declines.

• Wages have been increasing, helping serious buyers remain in the market despite high mortgage rates and home prices.

2. Home Prices

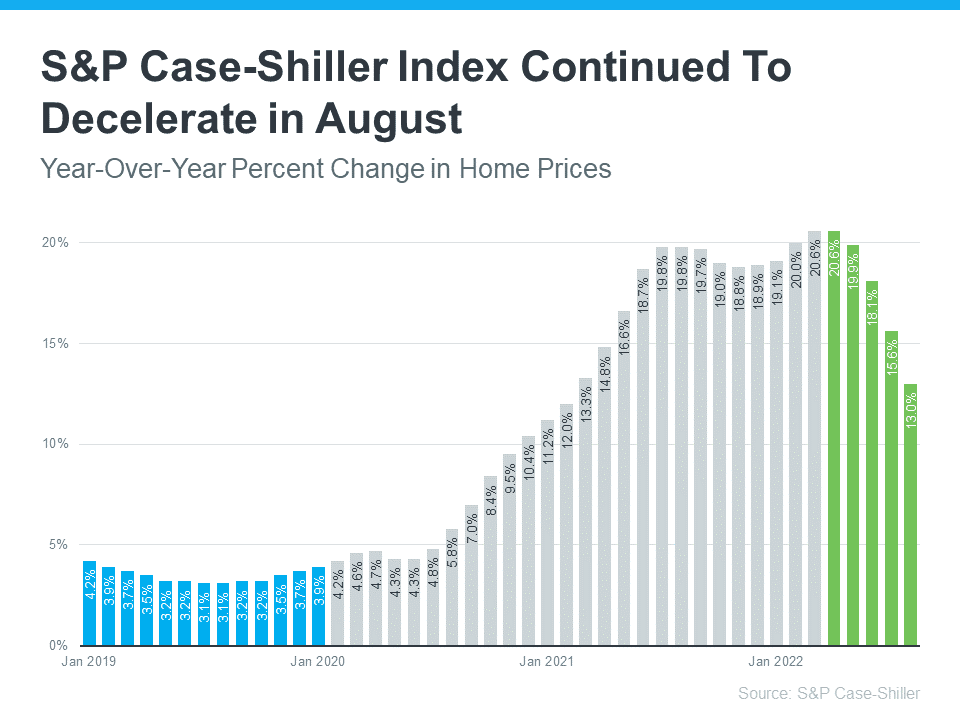

The second contributing factor to the housing market crisis is home prices. In recent years, home prices have risen rapidly, becoming unaffordable for many people. According to the most recent Home Price Index from S&P Case-Shiller, home values have decreased for five months in a row. (shown in green in the graph below):

The deceleration of the housing market is attributable to higher mortgage rates moderating buyer demand. When fewer buyers compete for properties, prices naturally go down since sellers are less likely to entertain bids below their asking price.

Home prices have increased since the start of the pandemic, but they are still lower than pre-pandemic. (shown in blue in the graph above). Although we have made progress, home prices are still not at the appreciation level of 4%, which is closer to normal. It becomes more difficult to afford a home and have purchasing power when both mortgage rates and home prices are high.

In some markets, prices are still high, while in others they are beginning to decline. It all depends on where you live. Contact a reliable real estate agent to get the inside scoop on your local market.

• Home prices have decelerated in the last five months, with average home values decreasing.

• Home prices are still elevated when compared to pre-pandemic levels.

• Appreciation rates are lower than normal, making it more difficult to afford a home.

• Prices vary greatly depending on the location

3. Wages

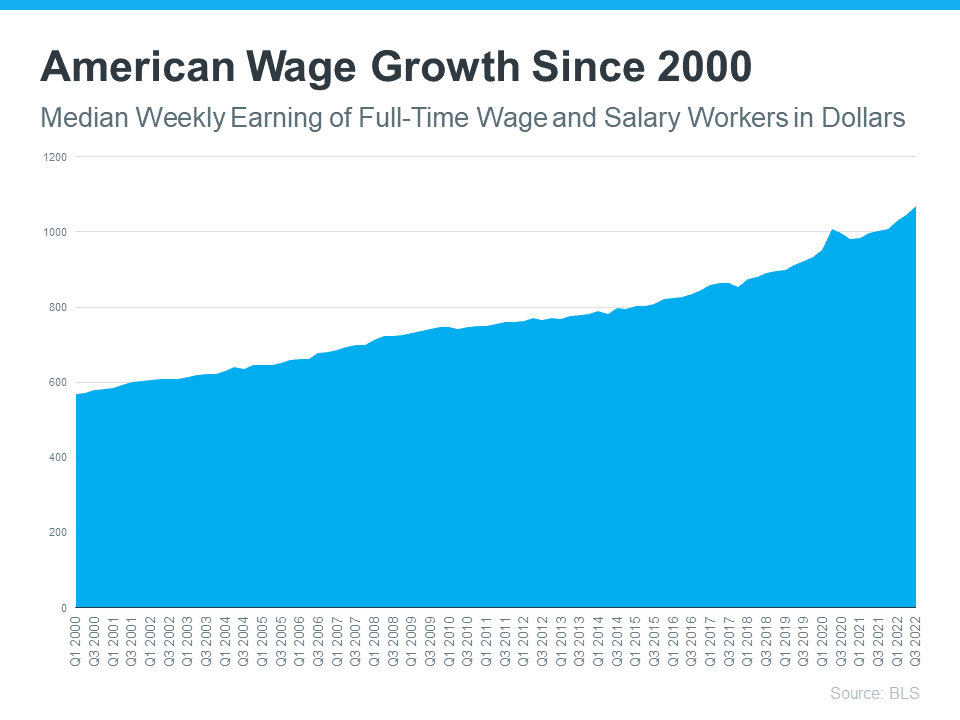

Finally, wages are another factor that should be considered when assessing affordability. Wages have been increasing over the past year, thanks in part to additional unemployment benefits and other stimulus programs.

According to the US Bureau of Labor Statistics, average hourly wages rose by 11.1% over the last year (not seasonally adjusted).

This is great news for prospective buyers because it means more people have the purchasing power to enter the housing market. The rise in wages has helped balance out some of the challenges of higher mortgage rates.

The below graph uses data from the Bureau of Labor Statistics (BLS) to demonstrate how wages have increased with time. This year is no exception.

As the Bureau of Labor Statistics (BLS) reports:

"Median weekly earnings of the nation's 120.2 million full-time wage and salary workers were $1,070 in the third quarter of 2022 (not seasonally adjusted), the U.S. Bureau of Labor Statistics reported…This was 6.9 percent higher than a year earlier…"

Consequently, affordability is not simply about mortgage rates; remember to also factor in wages and home prices. Numerous buyers are still going through with purchasing homes this year because salaries have been rising.

• Wages have increased over the past year due to additional unemployment benefits and stimulus programs.

• The US Bureau of Statistics reports that average hourly wages have increased by 11.1% (not seasonally adjusted).

• This wage rise has helped balance out some of the challenges that higher mortgage rates present.

• This is great news for prospective buyers as they now have the purchasing power to enter the housing market.

If you want to explore the topics further or have questions, reach out to a reliable advisor who can explain how these factors affect each other and what's happening in your area. As Leslie Rouda Smith, President of the National Association of Realtors (NAR), puts it:

"Buying or selling a home involves a series of requirements and variables, and it's important to have someone in your corner from start to finish to make the process as smooth as possible… and objectivity to deliver trusted expertise to consumers in every U.S. ZIP code."

The Bottom Line:

Housing affordability is determined by many factors, including mortgage rates, home prices, and wages. Mortgage rates have increased in recent months due to the Federal Reserve's efforts to raise inflation and drive economic growth. Home prices have also increased since the start of the pandemic but are still below pre-pandemic levels. Wages have been rising as of late, providing more people with purchasing power. Therefore, affordability is not simply about mortgage rates; remember to factor in wages and home prices. Consult a reliable real estate agent or advisor for more information!

Happy house hunting!